@djc i think it will, for SVB. but deposit insurance is now for-real effectively unlimited, don’t imagine banks won’t let that enable more egregious and expensive forms of yield-seeking recklessness going forward. absent a pervasiveness of regulation very hard to get right, competition to offer good effectively-insured deposit rates will be pushing everyone to push the envelope.

@djc the latter. it’s users of banks that will ultimately take the hit, much more than bank shareholders. an assessment on all banks means banks in general are likely to pass on the costs (as opposed to an assessment on a single bank, where competition might prevent passing on the cost).

[new draft post] Unlimited deposit insurance https://drafts.interfluidity.com/2023/03/13/unlimited-deposit-insurance/index.html

@gl33p yes, but if banking is competitive, mustn’t banks pass along a new cost either in the form of lower deposit rates, higher lending rates, or fees? or should we just acknowledge that in fact banking is not so competitive, so the connection between a new cost + customer rates and fees mb weak, so (perhaps, who can say?) the new cost might just drop out of shareholder profits and/or mgr comp. is there no funding mechanism, at least looking forward, that can ensure the latter?

what is the ultimate incidence of a “special assessment on banks, as required by law”? is it consistent with “no losses will be borne by the taxpayer”?

i hope the silicon valley community considers that if we had postal banks offering business deposit and payment services, they’d never have to worry about this kind of thing.

@allenholub @verizon i love the modals that DO have cancel buttons, but that just pop up again indefinitely if you do.

maybe this time we can think about explicitly segregating payments and deposits from investment-at-risk.

@mattlehrer yeah. in general the politics of bailouts would be harder and more bitter this time, and yeah wells in particular has quite the rep. they could wipe out equity and take into receivership but still operate the banks to hold depositors harmless while giving the public a measure of justice.

hopefully SVB's degree of maturity mismatch was unusual and it won't come to this kind of thing more broadly, but it's pretty shocking to leave big depositors hanging at a bank SVB's size.

@mike805 (you know the system is in trouble when people start using ATMs again with any great frequency…)

@mattlehrer the way this has been done, it risks a broad based rush to fragment deposits across institutions and entities in order to maximize FDIC coverage, or just into banks in the very top tier, which depositors might bet are still too-big-to-fail.

@mike805 all the vaults at banks are basically empty. your deposits are backed by loans and securities with little physical form, tracked in databases.

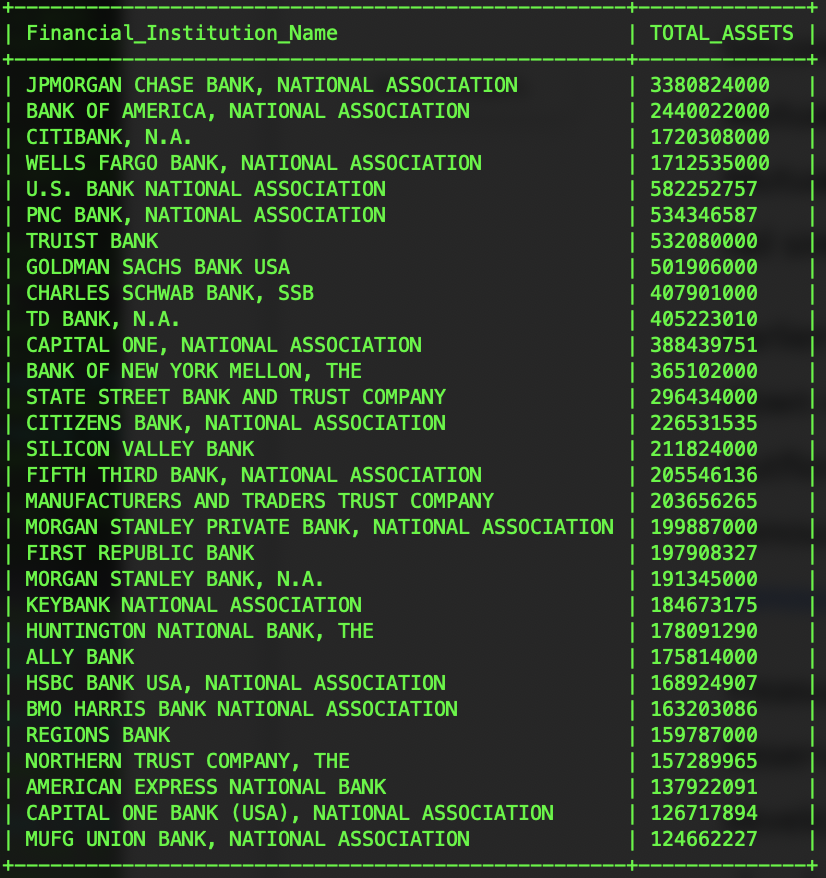

@mattlehrer it's an ascii table generated straight from an SQL query on the terminal. i guess #dolt left-justifies columns regardless of type...

Thirty biggest banks by total assets as of 2022-06-30

BREAKING: parent company of instagram and facebook announces name change to FEDI.

[/satire]

@stevendbrewer “wrong” relative to my habits will be well outweighed if it’s capable and genuinely free software. i will just have to make an effort.

the output of a LLM should be described as a Rorschach text.

@SteveRoth ha! we have so many overlapping obsessions.

@kims Thanks!

@stevendbrewer (i’ll take a look.)

@stevendbrewer (and thanks!)