@failedLyndonLaRouchite autarky is undesirable, but for a large diverse economy like the US an “autarky option”, the capacity if necessary to rely on domestic production at a cost, expensive but not existential, is desirable. we should always have reasonable alternatives should the terms of trade turn, or should somebody threaten to turn them. 1/

@failedLyndonLaRouchite diversification across many, friendly, foreign suppliers is another choice, but “friendly” can change and diversification doesn’t work well when changes can correlate. There are judgment calls here, but for the US simply to lack core industrial capacities it can expand if necessary is terribly foolish. 2/

@failedLyndonLaRouchite and yes, the fact that the capabilities that make for a domestic ship-building industry are important complements to military production (and can reduce the costs of necessarily more source-selective military procurement) is an important and relevant consideration. /fin

The thing is, we really want and need a cost-competitive domestic ship-building industry. The Jones Act is obviously horrible when applied to PR, AK, and HI, and may well be the wrong tool in general. But it’s no use railing against it without talking about better, alternative means of structuring a vibrant, more competitive ship-building industry. Why must it be so expensive here? We tried pretending we could just have no industrial policy. That worked out very poorly. https://www.theatlantic.com/ideas/archive/2023/03/jones-act-ship-american-1920-law-industrial-policy-joe-biden/673433/

why don't they don't just put Chris Rufo on the board? https://www.motherjones.com/politics/2023/03/mike-flynn-and-maga-activists-wage-war-against-a-florida-hospital/ ht Kevin Drum

"When it comes to Biden’s plan to forgive student debt…the same venture capitalists begging for handouts were howling about…unfairness. That kind of attitude is so deeply baked into American culture that policymakers have become allergic to clear + direct state action. Instead, they try to hide their tracks—instead of social-democratic welfare programs, we get benefits buried in the tax code so people can pretend they aren’t beneficiaries of government help." @ryanlcooper https://prospect.org/economy/2023-03-14-economy-could-not-exist-without-government/

one interesting aspect of the #SVB saga is that the VC community ran, when you might have expected that tight-knit community to save its bank J. P. Morgan (the person) style.

to what degree was that choice — run vs cooperatively save — conditioned by a some VCs stake, ideological and financial, in bitcoin as the inevitable replacement for a fundamentally broken and corrupt banking system?

i’m a huge @ddayen fan, and i agree that SVB’s customer base is particularly unsympathetic.

but the idea businesses should in general split deposits or use CDARSes and other techniques that basically game the deposit insurance limit is not ideal. if they do, it puts FDIC on the hook anyway, but at waste of lots of people’s time, generates unnecessary complexity, creates fee opportunities for new species of useless finance professionals. 1/

https://prospect.org/economy/2023-03-13-silicon-valley-bank-bailout-deregulation/

i 1000% endorse his mocking condemnation of the “crapo bill” and its supporters though.

it probably is not a coincidence that precisely the banks who took advantage of that abomination (hint — not predominantly small community banks) are now the locus of a new crisis. (thanks Rs and sell-out Ds.)

deposits and payments should be structurally segregated from risk investing (including traditional commercial-bank risk investing, not just the glass-steagall stuff). postal banking ftw. /fin

[new draft post] Unlimited deposit insurance https://drafts.interfluidity.com/2023/03/13/unlimited-deposit-insurance/index.html

what is the ultimate incidence of a “special assessment on banks, as required by law”? is it consistent with “no losses will be borne by the taxpayer”?

i hope the silicon valley community considers that if we had postal banks offering business deposit and payment services, they’d never have to worry about this kind of thing.

maybe this time we can think about explicitly segregating payments and deposits from investment-at-risk.

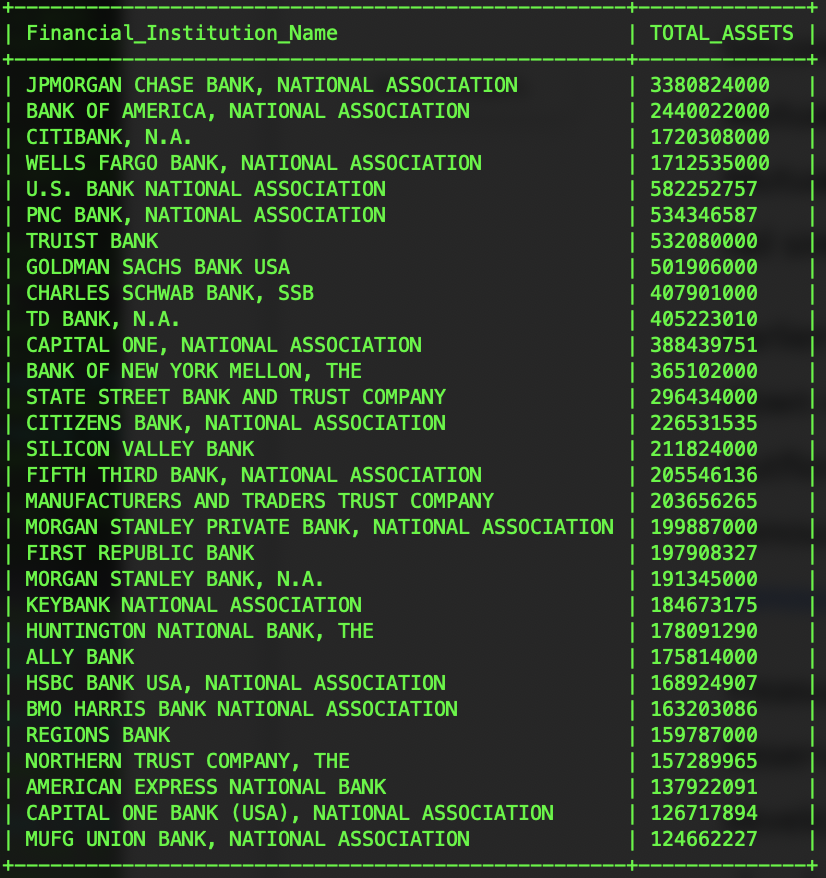

Thirty biggest banks by total assets as of 2022-06-30

BREAKING: parent company of instagram and facebook announces name change to FEDI.

[/satire]

the output of a LLM should be described as a Rorschach text.

i learned desktop publishing on Aldus PageMaker, migrated with it to Adobe then, to InDesign for which to this day, absurdly given how little i use it, i pay monthly.

we did a flyer together, and now the kid wants to learn how to layout and design pages. i’d rather not get his habits tangled with Adobe software. what should we use?

Something went wrong. Try reloading.

[new draft post] Libertarians and hierarchy https://drafts.interfluidity.com/2023/03/08/libertarians-and-hierarchy/index.html

On the "new wave of search engines" #DmitriBrereton https://dkb.blog/p/the-next-google (from April 2022)

what if we are all bots and you are living inside some digital Truman show?